URD 2024

-

Introduction

In addition to historical information, this Universal Registration Document includes forward‑looking statements and unaudited consolidated pro forma financial information.

Any historical information contained in this document is not indicative of future performance. All statements included in this document other than statements of historical facts, including, without limitation, those regarding financial position, business strategy, plans and objectives of management for future operations (including development plans and objectives) are forward‑‑looking statements. The forward‑looking statements are generally identified by the use of forward‑looking words, such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “project”, “predict”, “target”, “will”, “should”, “may” or other variations of such terms, or by discussion of strategy. These statements relate to Ayvens’ future prospects, developments and business strategies and are based on analyses or forecasts of future results and estimates of amounts not yet determinable. These forward‑looking statements represent the view of Ayvens only as at the dates they are made, and Ayvens does not have any obligation to update forward‑looking statements, except as may be otherwise required by law. Such forward‑looking statements are based on numerous assumptions regarding present and future business strategies and the relevant future business environment and involve known and unknown risks, uncertainties and other important factors that could cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward‑looking statements. These include changes in general economic and business conditions, as well as the factors described in Section 4.1 “Risk Factors” of this Universal Registration Document.

The information herein may contain data that may no longer be complete or current. To the extent available, the industry, market and competitive position data contained in this Universal Registration Document come from official or third party sources. Third party industry publications, studies and surveys generally state that the data contained therein have been obtained from sources believed to be reliable, but no representation or warranty, express or implied, is made that such information, assumptions, performance data, modelling or scenario analysis is accurate, complete or up to date and it should not be relied upon as such. While Ayvens believes that each of these publications, studies and surveys has been prepared by a reputable source, Ayvens has not independently verified the data contained therein. In addition, certain of the industry, market and competitive position data contained in this document come from Ayvens’ own internal research and estimates based on the knowledge and experience of Ayvens’ management in the market in which it operates. While Ayvens believes that such research and estimates are reasonable and reliable, they, and their underlying methodology and assumptions, have not been verified by any independent source for accuracy or completeness and are subject to change without notice. Accordingly, undue reliance should not be placed on any of the industry, market or competitive position data contained in this Universal Registration Document.

This document contains certain tables and other management analyses (the "like‑for‑like Information") which have been prepared based on information provided by Ayvens or its affiliates. Numerous assumptions have been used in preparing the like‑for‑like information, which may or may not be reflected in the material. As such, no assurance can be given as to the like‑for‑like information’s accuracy, appropriateness or completeness in any particular context, or as to whether the like‑for‑like information and/or the assumptions upon which they are based reflect present market conditions or future market performance. The like‑for‑like information should not be construed as either projections or predictions or as legal, tax, investment, financial or accounting advice.

The unaudited pro forma consolidated financial information included in this Universal Registration Document has been prepared in accordance with Annex 20 of Delegated Regulation 2019/980 supplementing European Regulation 2017/1129 and by applying the guidelines issued by ESMA (ESMA32‑382‑1138 of 4 March 2021) and the provisions of AMF Position‑Recommendation 2021‑02 on pro forma financial information, using historical consolidated financial information of ALD SA and LeasePlan Group B.V., together with its subsidiaries (the “LeasePlan Group”). It is presented for illustrative purposes only and should not be considered to be an indication of the results of Ayvens following the acquisition of the LeasePlan Group.

-

1.1History and development

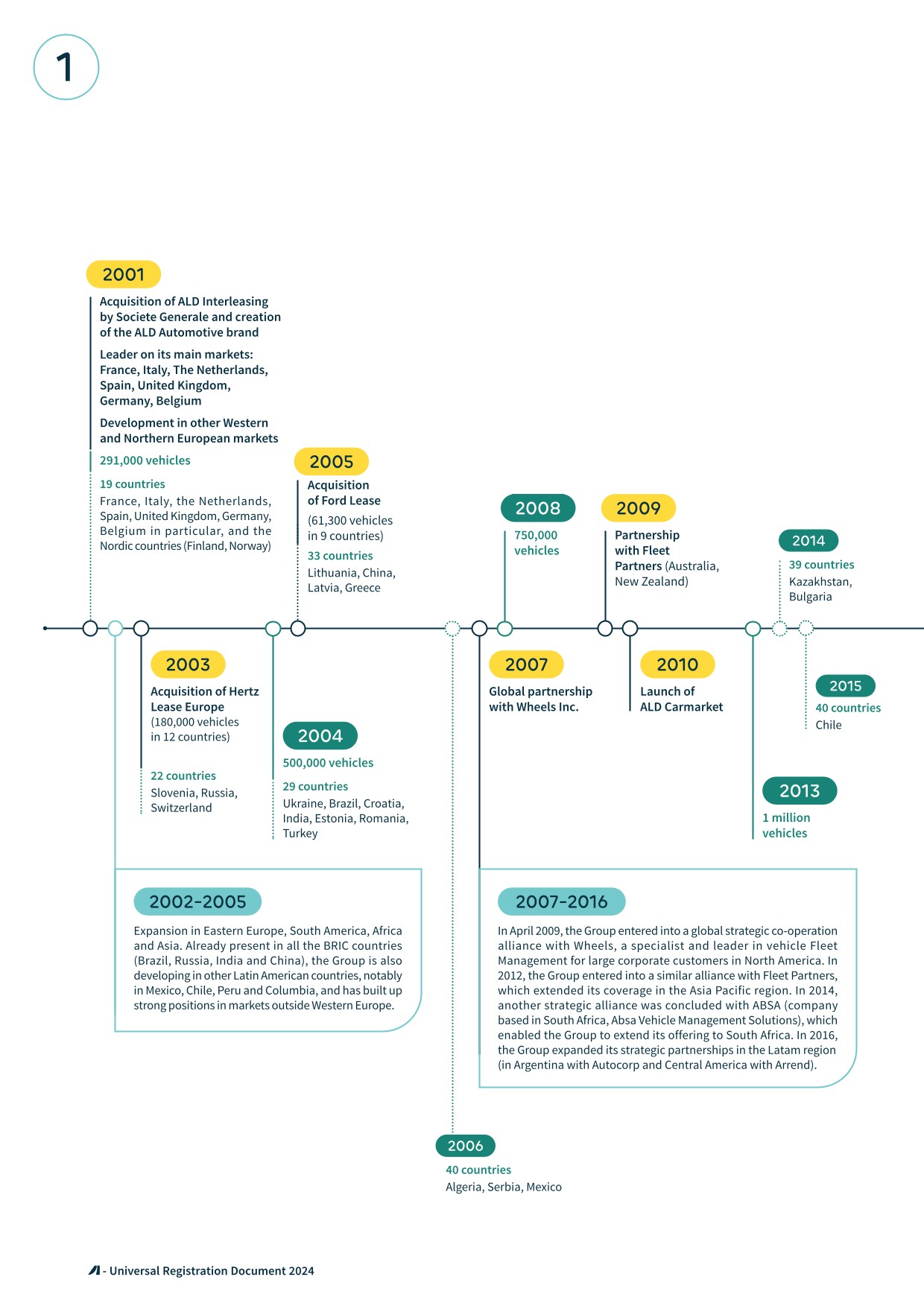

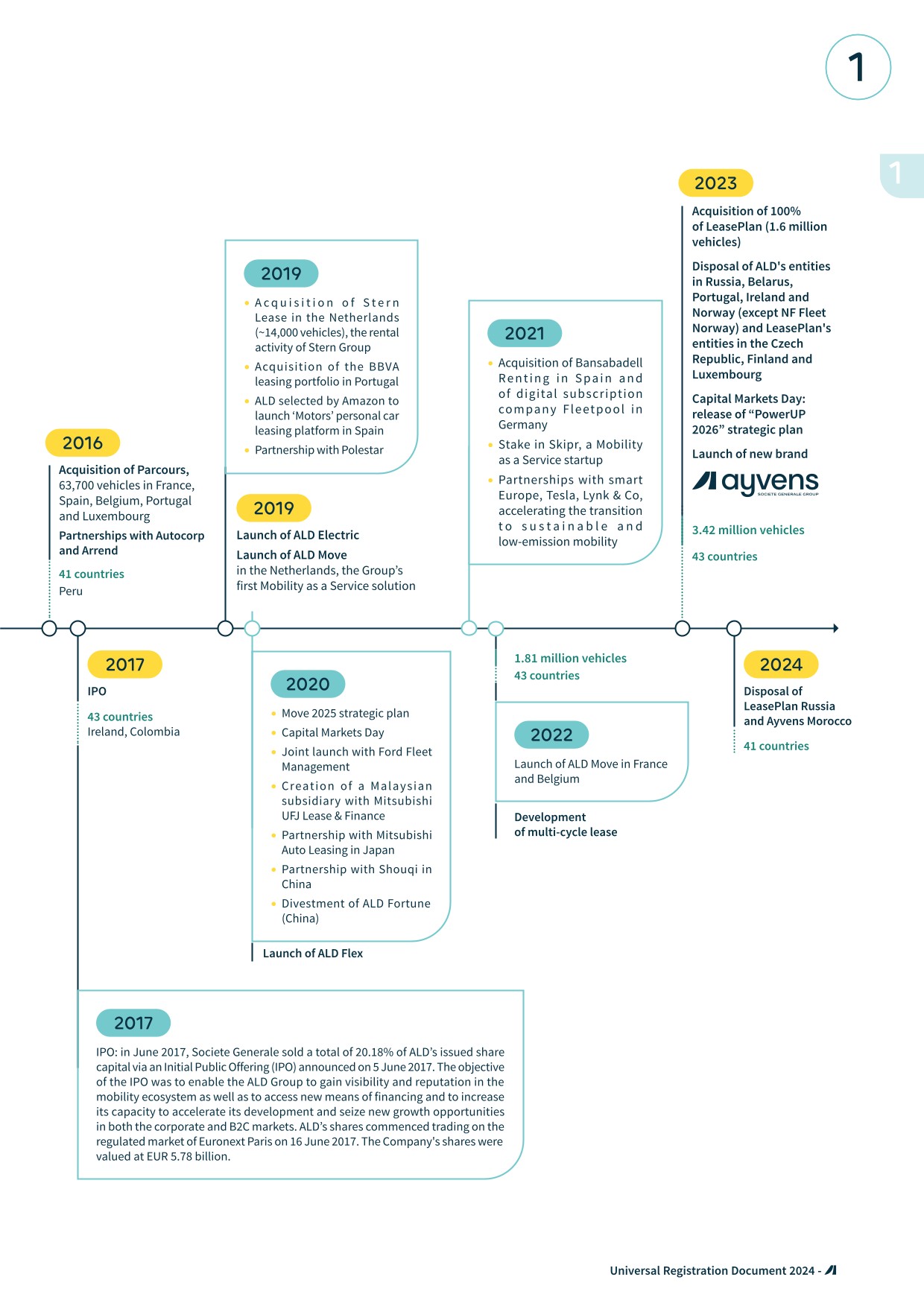

The Company was incorporated in 1998 under its former corporate name “Lysophan”. In 2001, the former corporate name was replaced by “ALD International”. In March 2017, this was in turn changed to “ALD”. In October 2023, the new brand “Ayvens” was launched following the acquisition of LeasePlan, to unite ALD and LeasePlan together under a single identity.

Key milestones in the Company’s development include the acquisition by Societe Generale, its parent company, of Deutsche Bank’s European car leasing activity in 2001 and Hertz Lease Europe in 2003, thereby consolidating the Group’s leading market position in almost all of its key European markets.

Since 2004, the Group has established multiple subsidiaries in Central and Eastern Europe and South America, Africa and Asia. Already present in the BRIC countries (Brazil, Russia and India – plus China, which it exited in 2020), the Group has further expanded into Latin American countries, notably Mexico, Chile, Peru and Colombia, and has built up strong positions in markets outside Western Europe.

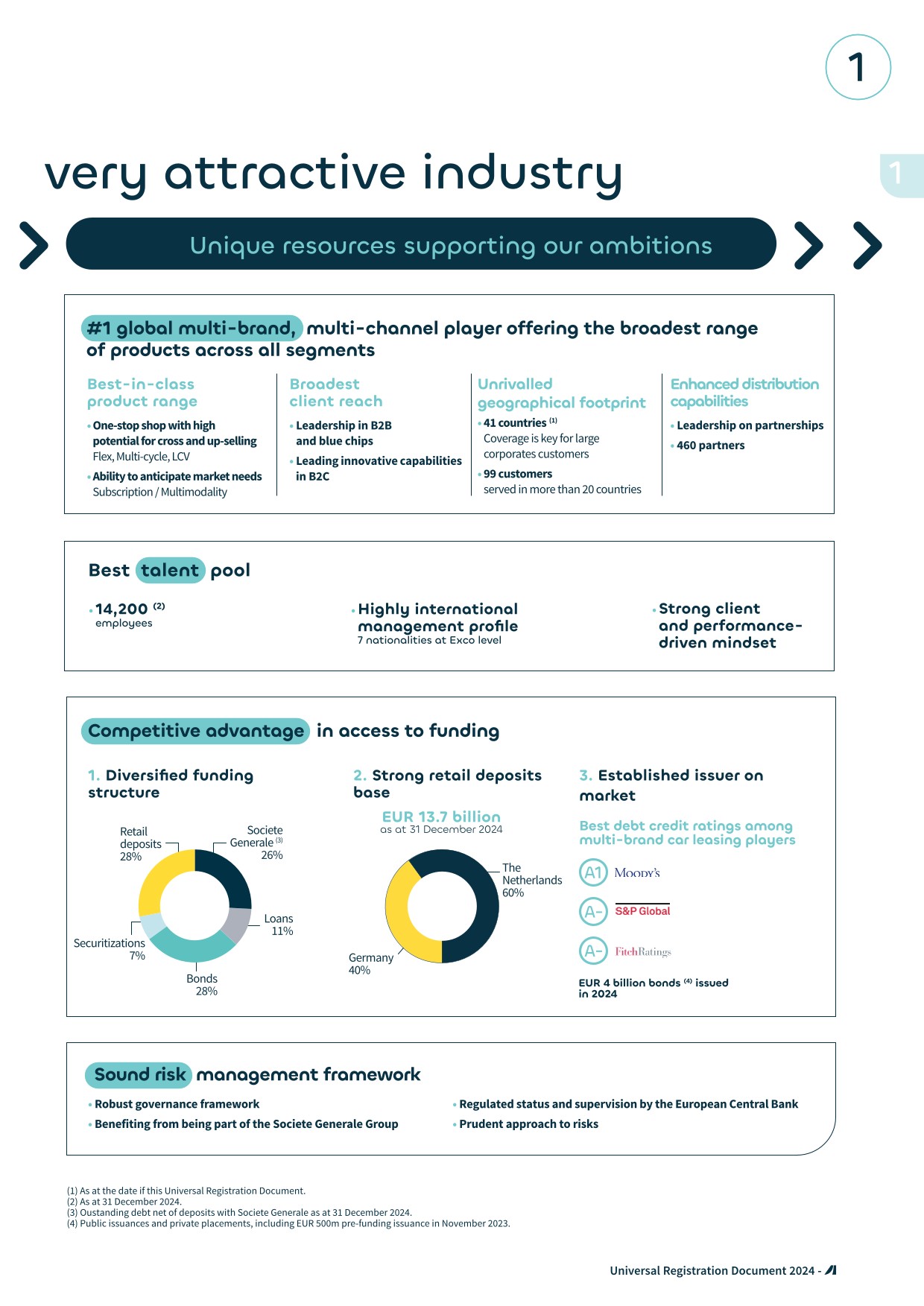

In 2009, the Group entered into a global strategic co-operation alliance with Wheels, a specialist and leader in vehicle Fleet Management for large corporate customers in North America. In 2012, the Group entered into a similar alliance with Fleet Partners, which extended its coverage in the Asia Pacific region. In 2014, another strategic alliance was signed with ABSA (South Africa-based company Absa Vehicle Management Solutions), which extended its coverage to South Africa. In 2016, the Group expanded its strategic alliance in the Latam region: in Argentina and Uruguay with Autocorp and Central America with Arrend. In 2020, new alliance were added in Asia, notably with Mitsubishi Auto Leasing Corporation in Japan, with Mitsubishi HC Capital Inc. in Malaysia, and with Shouqi in China. In 2023, the alliance with Fleet Partners in Australia and New Zealand was terminated and replaced by an alliance with SG Fleet. These alliances helped to expand the Group’s global presence which included, either directly or through such alliances, 57 countries as at the date of this Universal Registration Document.

In addition to its regional alliances, the Group has forged partnerships with 460 car manufacturers, banks and insurers, energy suppliers and mobility platforms. Aside from its direct distribution, the Group uses indirect distribution channels to offer its Full Service Leasing and Fleet Management.

In 2017, Societe Generale sold a total of 20.18% of ALD’s issued share capital via an initial public offering (IPO) announced on 5 June 2017. The objective of the IPO was to enable the ALD Group to gain visibility and reputation in the mobility ecosystem as well as to access new means of financing and to increase its capacity to accelerate its development and seize new growth opportunities in both the corporate and B2C markets. ALD’s shares commenced trading on the regulated market of Euronext Paris on 16 June 2017.

In 2021, the Group strengthened its position in Europe through the acquisition of Bansabadell Renting, boosting its presence in Spain. Moreover, the acquisition of a stake in Skipr offered the Group new growth opportunities in the field of consulting services for mobility transformation with digital access to multi-modal, flexible and sustainable solutions and the capacity to bolster its ALD Move offer in Europe.

In 2022, ALD successfully completed an EUR 1.2 billion rights issue, securing the financing of part of the cash component of the acquisition price for LeasePlan, one of the world’s leading Fleet Management and mobility companies.

In May 2023, ALD closed the acquisition of 100% of LeasePlan, for a total consideration of EUR 4.9 billion (1), paid through a combination of cash and ALD shares, to create the leading global sustainable mobility player with a total fleet of circa 3.4 million vehicles. Upon the acquisition of LeasePlan, which holds a banking licence, ALD became a Financial Holding Company, a regulated institution supervised by the European Central Bank.

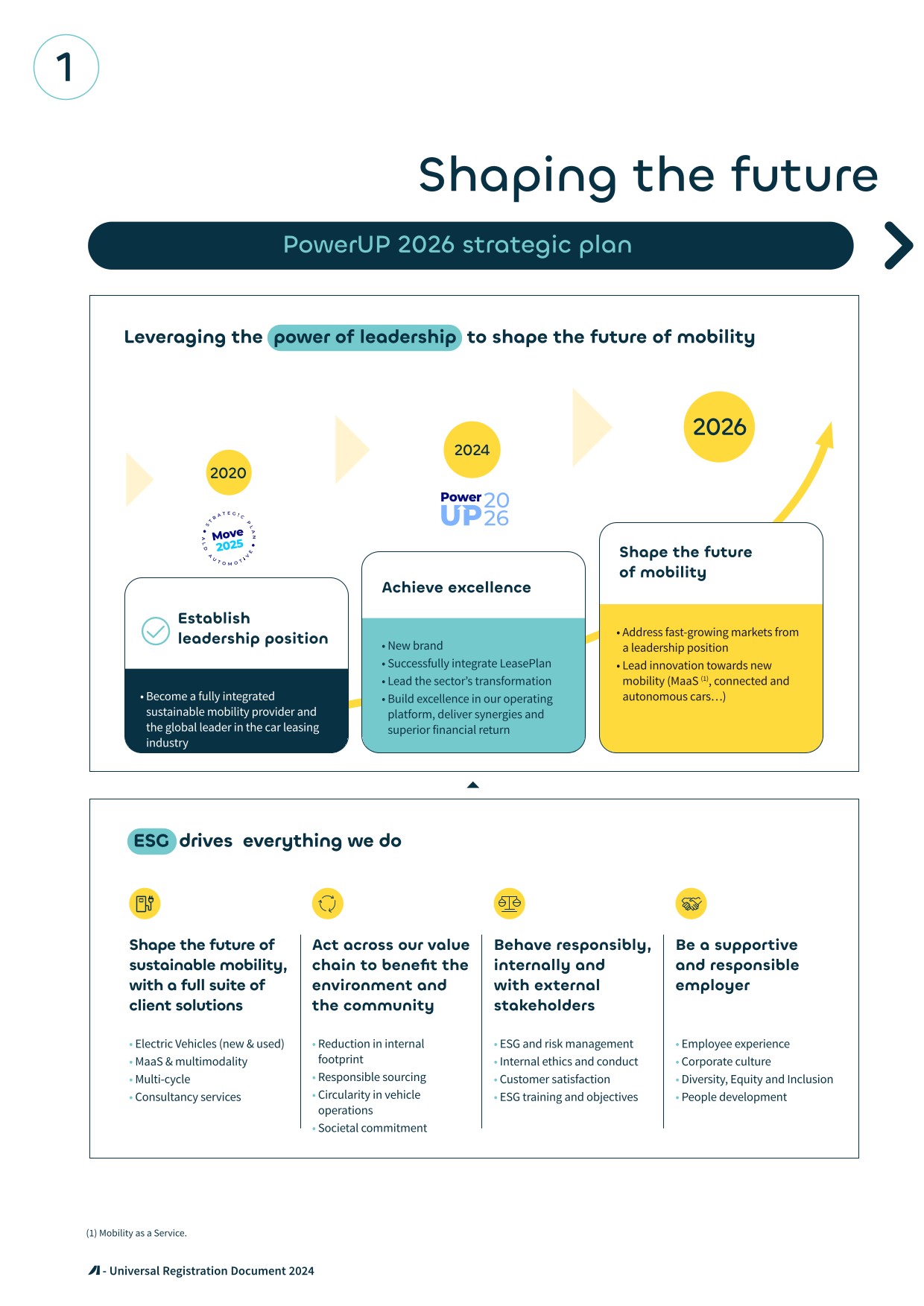

In September 2023, ALD I LeasePlan presented its “PowerUP 2026” strategic plan, following the transformative acquisition of LeasePlan.

-

1.2Detailed profile

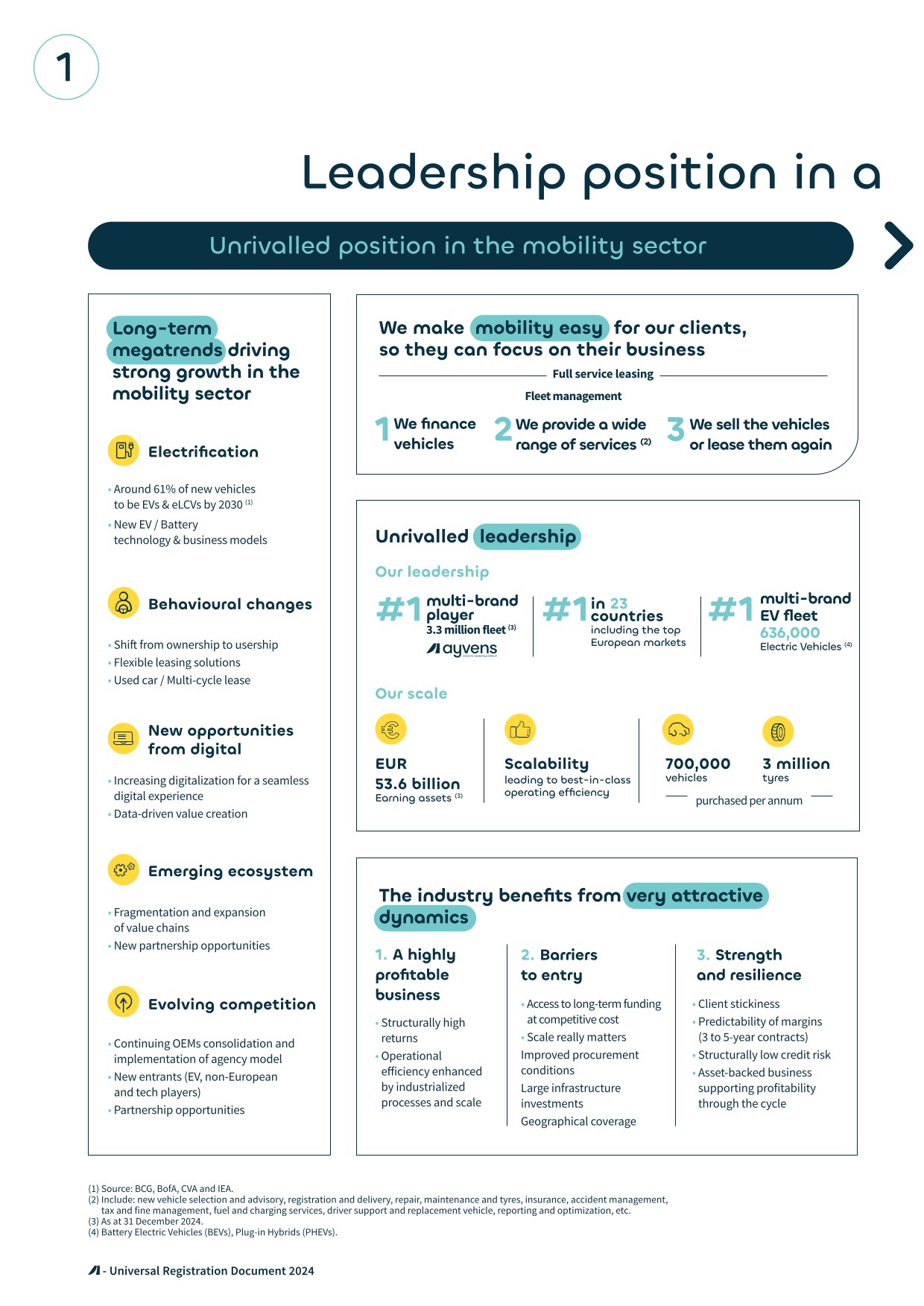

1.2.1Business model

Ayvens is a Full Service Leasing (2) (“Full Service Leasing”) and Fleet Management (3) (“Fleet Management”) Group with a managed fleet of 3.3 million vehicles as at 31 December 2024. It operates directly in 41 countries and through commercial alliances indirectly in 16 additional countries as at the date of this Universal Registration Document. The Group is active on the whole Full Service Leasing value chain and focuses on providing solutions encompassing a broad range of services that can also be provided on a standalone basis.

The Group benefits from a diversified income base consisting of three principal components: the Leasing margin (“Leasing margin”), the Services margin (“Services margin”, and together with the Leasing margin, the “Total Margins”) and the Used Car Sales result and depreciation adjustments (“Used car sales result and Depreciation adjustments”).

Under its primary product offering, Full Service Leasing, the Group purchases vehicles with a view to leasing them to its customers. During the lease period, it earns a financing spread (Leasing margin) equal to the difference between, on the one hand, the leasing contract revenue it receives from customers, equal to the expected depreciation of the leased vehicle plus the interest charge for funding the vehicle as well as other associated costs, and, on the other hand, the leasing contract costs, which are comprised of the costs for the expected depreciation of the leased vehicle and the costs of funds the Group incurs to fund the vehicles.

The Group also generates income from the wide range of services that it offers under both its Full Service Leasing and Fleet Management products, such as maintenance and repairs, insurance, tyres and replacement vehicles. This income is referred to as the Services margin, representing the difference between the fixed costs invoiced in the monthly rental and the costs incurred by the Group in providing these services.

Lastly, the Group generates income from the remarketing of its used vehicles at the termination of a lease contract, referred to as the Used Car Sales result. The Group markets and sells used vehicles at the end of their lease through various channels: professional dealers or traders, directly to the users of the vehicles or sales to individual customers, respectively through its global auction platforms dedicated to traders and dealers (Ayvens Carmarket) and through online vehicle sales to retail customers (under the Ayvens brand) with the support of 50 showrooms in 21 countries. Ayvens Carmarket is the main channel used to market and resell its used vehicles. Via this website, the Group can also remarket, on behalf of its customers and partners, used cars which it does not own, earning a fee from the proceeds of the sale. Depreciation adjustments are part of the Used car sales activity and represent an estimation of expected gains or losses on future disposal of vehicles and are spread over remaining duration of contracts.

The following table sets out the distribution of the Group’s consolidated Gross operating income (“Gross operating income”) for the financial years ended 31 December 2024, 2023 and 2022:

-

1.3Information technology

IT systems and telecommunications are an integral part of the Group’s policy for managing points of sale and reservations across all distribution networks. The mission of the Group’s central IT Department covers mainly the rental management system used by most subsidiaries, the online auction platform dedicated to professional dealers for the acquisition of used vehicles, and other important areas such as the MyAyvens platform. The Group’s larger subsidiaries have their own IT Departments and generally their own platforms, which they manage locally with the help of external service providers where necessary. The Group’s central IT Department approves the subsidiaries’ IT budgets. Local IT teams are supervised locally. However, IT systems for smaller subsidiaries are generally managed by the Group’s central IT Departments.

The central back-office systems (SOFICO MILES, ALDAVAR and NOLS) are the centrepieces of the Group’s IT systems and cover most subsidiaries that do not have their own IT Department. These applications support all of the Group’s back-office activities and processes and cover the entire contract cycle and asset base, as well as all vehicle service management. The Group’s ALDAVAR and NOLS softwares are gradually being replaced by a solution recognised on the market, SOFICO MILES.

The Group seeks to offer innovative and inexpensive services. To do this, it invests regularly to maintain and improve its IT system. All IT projects are regularly and centrally evaluated in the light of business needs. Particular attention is paid to technical projects aimed at establishing and guaranteeing the continuity of services and their security. The added value of each application project aimed at maintaining and improving the operational capabilities of the system is assessed, in particular, with regard to revenue growth, cost reduction and compliance and legal risks.

An Information System Architecture and Strategy Committee is responsible at the holding level for verifying the conformity of the Group’s IT strategy, around the main cross-functional pillars (Project Management Operations, Architecture, Infrastructure, Security, Data and Functional Processes). This strategy is in line with the guidelines given by Societe Generale (taking into account the specificities of the Group’s activity). The Group has established security principles designed to reduce the risk of information leakage and external fraud, and to make the services provided on the Internet more reliable, while preserving the customer experience. The Group’s security policy is defined in accordance with the security framework established by Societe Generale. Each Group entity must integrate its own needs and take into account the context (organizational, structural, legislative, regulatory, contractual and technological) in which it operates. All local information security policies must be validated in accordance with the specific Group policy. Each entity must designate a local Security Correspondent, who will be responsible for the IT security of the entity or region concerned. This Security Correspondent is required to apply the Group’s procedures and to establish/update local security policies.

The Group’s digital application environment comprises several major platforms developed internally or in partnership with certain customers and preferred suppliers from ALD and LeasePlan. These platforms are subject to continuous improvement or expansion to new countries or customer partnerships and will be rationalised into one single environment. Some modules and innovations also aim to encourage data-driven decision-making (Big Data), to adapt products and prices in real time (Dynamic Pricing) and, more generally, to accelerate digital development and strengthen the customer relationship management strategy (Cloud CRM). These particularities offer the Group the double advantage of benefiting from economies of scale by pooling its technical capital between several solutions, as well as the ability to rapidly deploy its solutions to all its subsidiaries.

LeasePlan’s Next Generation Digital Architecture (NGDA) programme was launched in 2019 to deliver a harmonized and standardized global digital architecture. The first phase of the program consisted of an initial rollout to three entities with the intention of then rolling out the platform across the rest of the Group. After a strategic review of the programme was conducted following the closing of the LeasePlan acquisition, a decision was made by the Group to stop new developments across the NGDA perimeter. Following this decision, a revised transformation strategic plan was defined targeting the same objective: a global and standard IT platform (Global Mobility Platform) based on Societe Generale, ALD and LeasePlan best assets. However, the transformation path is very different from NGDA with a staggered approach decoupling transformations of distribution (customer channels, client engagement solutions), product factories and foundations. This phased approach enables a flexible adjustment to financial trajectory and can be prioritized per geography and/or value chain (based on business cases). It starts in 2025 with several strategic initiatives: rationalizing infrastructure through Societe Generale, moving to one global CRM (ALD's one) and decommissioning redundant applications.

-

1.4Strategy

The following discussion of Ayvens’ results of operations and financial condition contains forward‑looking statements. Ayvens’ actual results could differ materially from those that are discussed in these forward‑looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this Universal Registration Document, particularly under “Risk Factors”.

Having established a leadership position through its “Move 2025” strategic plan and the acquisition of LeasePlan, Ayvens intends to lead the sector’s transformation under the “PowerUp 2026” plan. The objectives are to achieve excellence in its operating platform and deliver synergies and superior financial return through the successful integration of LeasePlan and the launch of a new brand. Ayvens’ long-term strategy is to leverage on the power of leadership to shape the future of mobility by addressing fast-growing markets and fostering innovation towards new mobility like Mobility-as-a-Service (MaaS) and connected and autonomous cars. Ayvens’ strategic ambition is to become a Leading Global Sustainable Mobility Player.

1.4.1Megatrends and vision for 2030

Ayvens is a unique position to lead the rapidly changing mobility ecosystem in the context of long-term megatrends:

- ●electrification is progressing under the effect of regulatory factors and increased climate risks awareness. The transition from ICE cars to EVs (BEVs and PHEVs) has reached an inflection point and EVs are becoming more attractive and affordable. The speed of transition has also turned out to be volatile, as we have witnessed with the recent material slow down in EV deliveries. This, however, does not change the long-term trend;

- ●behavioural trends such as the changing face of urban mobility and the shift from ownership to usership will foster the development of car leasing on the consumer segment and new solutions like flexible leasing and multi-cycle/used car lease;

- ●new opportunities from digital will arise, as “on‑demand” mobility and seamless digital customer journeys are becoming essential for customers and data-driven value propositions emerge;

- ●the rise of digital models will also fragment and expand the traditional value chain as niche players will emerge, creating new ecosystems with new competitors but also opportunities for partnerships;

- ●competition in the industry is changing, with continuing OEMs consolidation and the entrance of new players (EV and non-European players, new mobility and tech players), also creating opportunities for partnerships.

Based on these megatrends, Ayvens’ long-term vision for 2030 is to become a global mobility platform, offering all types of mobility on the path towards zero emissions and where circular economy in the form of multi-cycle lease will have more emphasis. Cars will become increasingly connected, and eventually fully autonomous, and mobility will move beyond the car towards Mobility-as-a-Service (MaaS), by including different modes of sustainable transportation.

In this context, it is critical for Ayvens to achieve excellence to further strengthen its operating platform capabilities and leadership position in the market to lead the sector’s transformation and shape the future of mobility over the long term. These strategic ambitions have been translated into the “PowerUp 2026” plan, which is based on three major promises and one commitment.

-

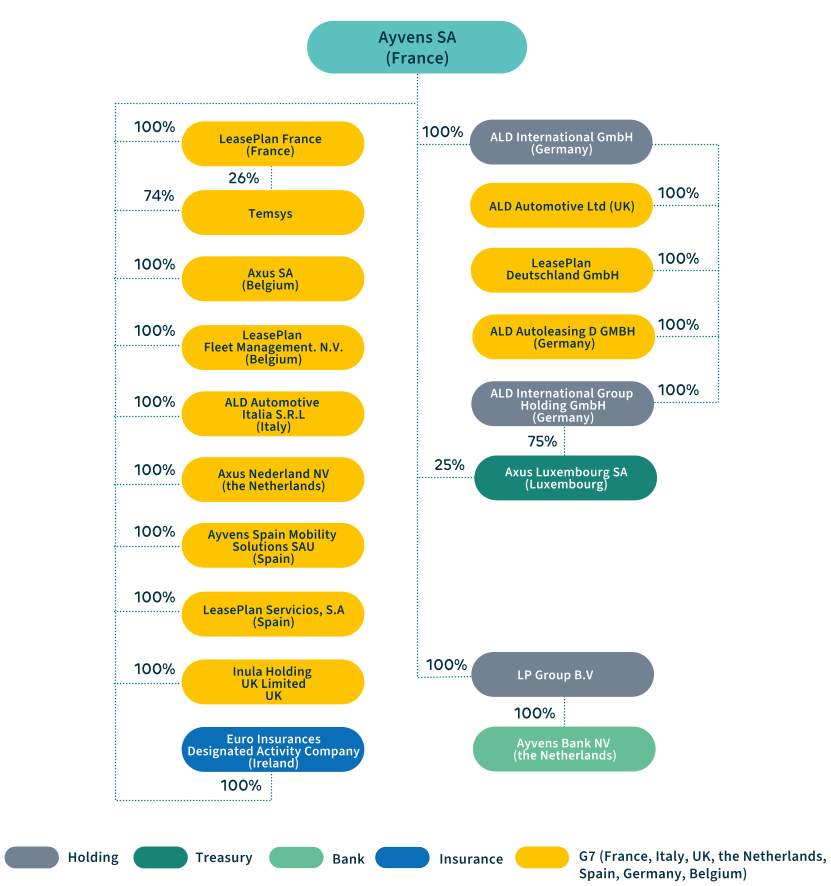

Structure of Ayvens Group

The simplified organisational chart below sets forth the legal organisation of the Group as at the date of this Universal Registration Document. The percentages indicated represent the percentages of share capital.

Ayvens SA does not carry out any leasing activities itself. Its primary role is to act as a holding company for the Group subsidiaries, to set the strategic direction of the Group, and to supervise the activities of the individual operating companies of the Group. In May 2023, following the acquisition of LeasePlan, which holds a banking licence, Ayvens SA became a Financial Holding Company, a regulated institution supervised by the European Central Bank. Ayvens’s central functions include notably the following key activities:

- ●supervision and support to the subsidiaries;

- ●management of relationships with Large Corporate Accounts and partners;

- ●central procurement activities to negotiate volume bonuses with manufacturers and other suppliers (such as tyres, short term rental, etc.);

- ●treasury, central funding (including administering the Group’s EMTN bond issues);

- ●finance;

- ●investor relations;

- ●communication;

- ●transformation and integration;

- ●human ressources;

- ●corporate and social responsibility;

- ●pricing;

- ●legal and corporate affairs;

- ●risk and compliance;

- ●digital and IT.

-

Subsidiaries

Main subsidiaries

Temsys SA (France), a limited liability company (société anonyme), is wholly owned by the Company. Its primary corporate purpose is the acquisition, sale and long-term leasing of cars and insurance brokerage. Temsys SA indirectly holds 100% of Parcours SAS.

ALD Automotive Italia SRL (Italy), a limited liability company (societa a responsabilita limitata), is indirectly wholly owned by the Company. Its primary corporate purpose involves the short and long-term leasing of vehicles, the sale and purchase of road transport vehicles, the operation of garages and machine workshops, the maintenance and repair of road transport vehicles both directly and via third parties and the provision of ancillary services.

ALD Automotive Group Limited (UK), a limited liability company, is an indirect subsidiary wholly owned by the Company. Its primary corporate purpose is the renting and leasing of cars and light motor vehicles.

ALD Autoleasing D GmbH (Germany), a limited liability company, is an indirect subsidiary wholly owned by the Company. Its primary corporate purpose is the short-, medium- and long-term leasing of all types of moveable goods, in particular German and foreign cars.

Ayvens Spain Mobility Solutions SAU (Spain), a limited liability company (sociedad anónima), is indirectly wholly owned by the Company. Its primary corporate purpose is the study, coordination, planning, calculation of costs and management of the purchase, sale and non-financial leasing of vehicles and vehicle fleets for individuals and legal entities, public or privately owned, and the administration, advising and optimisation of costs of these and related activities and the activities of insurance agent.

Axus SA (Belgium) is a limited liability company (société anonyme). Its primary corporate purpose is the manufacture, trade, operation, rental, including financial leasing, of all elements relating directly or indirectly to motor vehicle equipment, equipment relating to other means of transport, mechanical engineering or other. Furthermore, the Company is able to offer all mobility services and solutions, both in terms of travel, workspaces and connections, and is an intermediary for companies providing mobility solutions.

Euro Insurances DAC (Ireland), trading under the name Ayvens Insurance, a Designated Activity Company limited by shares, is wholly owned by the Company. Its primary corporate purpose is to deliver carry out the motor insurance and reinsurance products business (CASCO and MTPL programs) to Group entities.

Axus Luxembourg SA (Luxembourg), a limited liability company, indirectly wholly owned by the Company. Its primary corporate purpose is the leasing of moveable assets of any kind and real property and assistance in the financing of companies in which it has an interest.

Axus Nederland BV (the Netherlands), a private limited liability company (besloten vennootschap), is indirectly wholly owned by the Company. Its primary corporate purpose is the sale, purchase, renting, leasing, import and export of trade goods, and in particular motor vehicles, as well as the holding of companies. It also provides financial, managerial and administrative services to such companies.

Ayvens Bank NV (the Netherlands), a private limited liability company (naamloze vennootschap), is an indirect subsidiary wholly owned by the Company, that focusses on attracting retail deposits. Ayvens Bank NV holds a banking licence allowing it to raise deposits under the Dutch deposit guarantee scheme and it operates as an online retail savings bank for private individuals in the Netherlands and Germany.

For more details, see Section 6.2 “Notes to consolidated financial statements”, note 41 “Scope of consolidation” in this Universal Registration Document. For more details on recent disposals and acquisitions, see Section 6.3.1 “Changes in the scope of consolidation in the year ended 31 December 2024” in the consolidated financial statements and Section 2.1.4.1 “Historical investments” of this Universal Registration Document.

-

Relationship with Societe Generale and funding

Funding

As at 31 December 2024, Societe Generale accounted for 26% of the Group’s funding net of short-term deposits on an arm’s length basis. The remaining 74% consisted of secured and unsecured funding, primarily raised from debt capital markets, securitizations, external banks and retail deposits collected in the Netherlands and in Germany.

The Group benefits from an intra-group funding agreement applicable to entities of Societe Generale. This agreement provides the terms and conditions of the loans which can be granted by Societe Generale or any of its subsidiaries to other Societe Generale entities. The agreement is of unlimited duration and cancellable by each party with one month’s notice, with existing loans remaining subject to the agreement until repayment. The funds provided by Societe Generale are granted via Societe Generale Paris, Societe Generale Luxembourg and some local Societe Generale branches and subsidiaries. Societe Generale Paris and Societe Generale Luxembourg finance Ayvens SA via the central treasury of the Group, which in turn grants loans denominated in different currencies to the Group’s operating subsidiaries as well as to its intermediate holding companies. As part of the liquidity management strategy, the Group treasury also places excess cash from borrowings and bonds proceeds on short-term deposits with Societe Generale.

As at 31 December 2024 the net outstanding financial debt(1) with Societe Generale stood at EUR 12,511 million of which deposits amounted to EUR 4,931 million (2023: EUR 13,330 million and EUR 2,685 million respectively). The net debt with Societe Generale included EUR 1,500 million of subordinated Tier 2 debt. The average residual maturity of senior debt was 1.5 years.

Upon closing of the LeasePlan acquisition, Ayvens issued EUR 750 million of Additional Tier 1 hybrid capital (AT1), fully subscribed by Societe Generale, whose purpose is to ensure the maintenance of an adequate management buffer over all solvency ratios. This AT1 capital is accounted for as equity instrument.

-

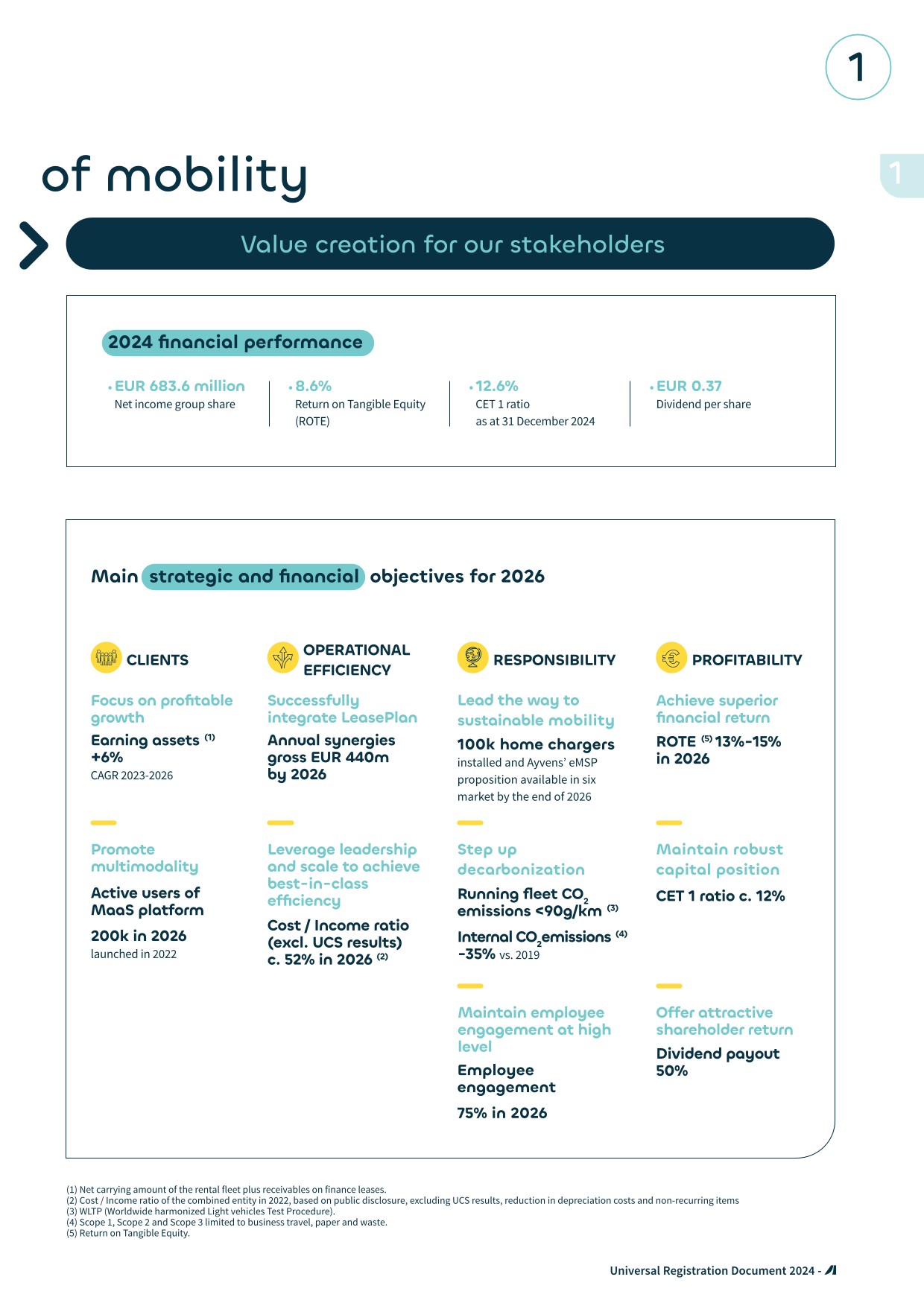

2.1Analytical review of 2024 activity

2.1.1Key indicators

The following table presents the Group’s key performance indicators (KPIs) for the financial years ended 31 December 2024, 2023 and 2022.

(in EUR million)

Year ended

31/12/2024Year ended

31/12/23 (1)(2)Year ended

31/12/22 (3)Leasing margin

1,070.7

775.5

758.8

Services margin

1,626.5

1,250.9

715.1

Used car sales result and depreciation adjustments

317.1

883.1

1,170.0

Gross operating income

3,014.3

2,909.5

2,643.9

Total Operating Expenses

(1,899.3)

(1,591.6)

(882.7)

Underlying cost/income ratio (4)

63.2%

62.8%

53.2%

Cost of risk (Impairment charges on receivables)

(128.5)

(70.7)

(46.1)

Cost of risk as % of Average earning assets (in bps) (5)

24

18

20

Other income/(expense)

(2.2)

(28.7)

(50.6)

Operating income

984.2

1,218.5

1,664.5

Share of profit of associates and jointly controlled entities

10.1

6.4

1.7

Profit before tax

994.3

1,224.9

1,666.1

Income tax expense

(284.2)

(359.4)

(446.0)

Result from discontinued operations

-

(77.6)

-

Non-controlling interests

(26.6)

(27.9)

(4.7)

Net income Group share

683.6

760.0

1,215.5

Other data (in %)

Return on Average Earning Assets (6)

1.3%

2.0%

5.1%

Return on Tangible Equity (7)

8.6%

11.5%

26.4%

Total equity on total assets (8)

14.8%

15.3%

22.0%

Common Equity Tier 1 ratio (9)

12.6%

12.5%

-

- (1)LeasePlan consolidated from 22 May 2023.

- (2)Including restatement of income statement and balance sheet in 2023. See section 2.1.3.3 for further detail.

- (3)FY 2022 was restated for i) IFRS 17, which applies from 1 January 2023 and ii) Change in GOI presentation as described in section 2.1.3.3

- (4)See section 2.1.3.3 for the definition.

- (5)“Cost of risk as % of Average earning assets” means the impairment charges for any period on receivables divided by the arithmetic average of earning assets at the beginning and the end of the period. In 2022, earning assets include entities held-for-sale in Russia, Belarus, Portugal, Ireland and Norway except NF Fleet Norway.

- (6)“Return on Average Earning Assets” means Net income for the financial year for any period divided by the arithmetic Average earning assets at the beginning and the end of the period. Earning assets is defined in the table below. In 2022, Average earning assets include entities held-for-sale.

- (7)See section 2.1.3.3 for the definition.

- (8)“Total equity on total assets” means total equity before non-controlling interests for any period, divided by total assets, as presented in the consolidated financial statements. See Section 6.1.2 “Consolidated statement of financial position”.

- (9)See section 2.1.3.3 for the definition.

(in EUR million)

Year ended

31/12/24Year ended

31/12/23Year ended

31/12/22Total fleet (in thousands of vehicles) (1)

3,288

3,420

1,806

o/w Full Service Leasing activity (on balance sheet) (1)

2,616

2 709

1 464

o/w Fleet management (off-balance sheet) (1)

672

710

342

Earning assets (2)(3)

53,565

52,055

24,798

Rental Fleet (4)

51,550

49,791

24,082

o/w residual value

33,133

32,829

15,869

Amounts receivable under finance lease contracts

2,015

2,264

716

Other data:

Average earning assets (4)(5)

52,810

38,426

23,643

- (1)Reported total fleet, including LeasePlan's fleet from 2023.

- (2)“Earning assets” corresponds to the net carrying amount of the rental fleet plus receivables on finance leases. In 2022, earning assets include entities held for sale.

- (3)LeasePlan consolidated from 22 May 2023.

- (4)“Rental fleet” as presented in the consolidated financial statements. See Section 6.1.2 “Consolidated statement of financial position”.

- (5)“Average earning assets” means, for any period, the arithmetic average of earning assets at the beginning and the end of the period .

-

2.2Trend information

The following discussion of Ayvens’ results of operations and financial condition contains forward-looking statements. Ayvens’ actual results could differ materially from those that are discussed in these forward-looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this Registration Document, particularly under “Risk factors”.

2.2.1Business trends

-

2.4Research and development, and licences

2.4.1Research and development

The Group is committed to innovating and offering value added solutions. It continues to strive to develop new products and new expertise. An Innovation Committee was created to share, prioritise, and accelerate innovation initiatives.

As a pioneer in mobility solutions, the Group regularly reviews its product offers and innovates to provide the best products for its customers, to support fleet managers in their daily work and to provide drivers with the solutions best suited to their needs.

In 2024, Ayvens continued to develop its portfolio of innovative products, including the electric offer, a holistic “end-to-end” approach to the powertrain shift for company and commercial fleets, which is now available in 34 countries.

On one side, local connected vehicle initiatives are in place, partnering with best-in class aftermarket devices providers and depending on the local expected use cases.

On the other side, the Ayvens central connected car platform has now more than 160,000 connected vehicles (ProFleet solution and cost avoidance insurance offering).Additionally, Ayvens has initiated tests with OEM telematics to offer connected vehicles through embedded telematics systems in the future.

Available in the Netherlands, France and Belgium, Move is Ayvens’ first Mobility as a Service offer. It helps clients make smart mobility decisions by providing daily mobility advice, considering an employee’s own calendar, real-time traffic data, the companies’ objectives (such as CO2 emissions, TCO, etc). Users get insights into their budget and travel history, while employers receive reporting on the mobility expenses in order to monitor the Company’s mobility and to efficiently manage and adapt the mobility policy as necessary.

-

2.5Cash flow

(in EUR million)

Year ended 31/12/2024

Year ended 31/12/2023

Year ended 31/12/2022(9)

Profit before tax

994.3

1,224.9

1,666.1

Adjustments for:

- ●rental fleet

8,897.3

6,067.6

3,573.6

- ●other property, plant and equipment

117.4

104.4

73.5

- ●intangible assets

101.2

130.3

25.5

- ●regulated provisions, contingency and expenses provisions

73.7

58.2

23.0

- ●insurance and reinsurance contract assets/liabilities(10)

(4.4)

115.3

-

- ●non-current assets held-for-sale – impairment

-

-

50.6

Depreciation and provision

9,185.2

6,475.7

3,746.2

(Gains)/Losses on disposal of plant, property and equipment

42.4

37.7

13.3

(Profit)/Loss on disposal of intangible assets

6.5

17.6

16.0

(Gains)/Losses on disposal of discontinued operations

(3.9)

-

-

Profit and losses on disposal of assets

45.0

55.3

29.3

Fair value of derivative financial instruments

(64.6)

276.6

1.8

Effect of hyperinflation adjustments

(86.6)

(95.7)

(52.4)

Interest Charges

1,924.5

1,052.6

244.1

Interest Income

(3,047.2)

(1,877.8)

(919.6)

Net interest income

(1,122.7)

(825.2)

(675.5)

Other

(6.4)

4.3

1.2

Amounts received for disposal of rental fleet

11,529.5

7,253.4

3,916.6

Amounts paid for acquisition of rental fleet

(21,950.3)

(18,257.1)

(9,554.0)

Change in working capital

1,040.0

249.1

(329.9)

Interest Paid

(1,565.5)

(1,044.6)

(196.2)

Interest Received

3,037.8

2,024.3

955.7

Net interest received

1,472.3

979.8

759.5

Income taxes paid

(433.0)

(375.6)

(195.5)

Net cash flow from operating activities (continuing activities)

603.1

(3,034.6)

(686.6)

Net cash flow from operating activities (discontinued operations)

-

44.2

-

Net cash flow from operating activities

603.1

(2,990.4)

(686.6)

Cash flows from investing activities

Acquisition of other property and equipment

(77.7)

(76.6)

(40.9)

Acquisition of intangible assets

(123.7)

(200.3)

(68.3)

Acquisition of financial assets (non-consolidated securities)

0.0

(3.2)

-

Effect of change in Group structure

21.2

1,967.8

35.4

Proceeds from the sale of discontinued operations, net of liquid assets sold

-

389.8

0.0

Long-term investment

81.4

66.9

79.1

Loans and receivables from related parties

(2,265.5)

(1,214.4)

(1,017.9)

Other financial investment

323.5

(179.8)

28.8

Cash flows from investing activities (continuing operations)

(2,040.9)

750.1

(983.8)

Net cash flow from investing activities (discontinued operations)

-

4.4

-

Net cash flow from investing activities

(2,040.9)

754.5

(983.8)

Cash flows from financing activities

Increase in borrowings from financial institutions

22,699.8

10,533.7

7,383.9

Repayment of borrowings from financial institutions

(21,946.9)

(6,665.6)

(6,731.3)

Proceeds from issued bonds

4,087.0

5,507.6

1,990.8

Repayment of issued bonds

(36,12.4)

(4,141.3)

(1,351.4)

Proceeds from deposits

12,142.8

5,737.1

-

Repayment of deposits

(10,104.7)

(5,285.3)

-

Proceeds from deeply subordinated notes

-

750.0

-

Payment of lease liabilities

(54.9)

(52.0)

(71.1)

Dividend paid on AT1 capital to equity holder of the parent

(73.1)

(7.8)

-

Dividends paid to the Company’s shareholders

(383.5)

(598.8)

(435.2)

Dividends paid to non-controlling interests

(6.4)

(8.6)

(9.9)

Dividend paid on AT1 capital to non-controlling interests

(518.4)

(36.9)

-

Capital increase

-

(3.1)

1203.4

Increase/decrease in shareholders’ capital

-

(4.9)

(5.4)

Net cash flow from financing activities (continuing activities)

2,229.3

5,724.2

1,973.8

Net cash flow from financing activities (discontinued operations)

-

(9.8)

-

Net cash flow from financing activities

2,229.3

5,714.4

1,973.8

Exchange gains/(losses) on cash and cash equivalents

(17.7)

(13.3)

(11.2)

Net increase/(decrease) in cash and cash equivalents

773.7

3465.2

292.1

Cash & cash equivalents at the beginning of the period

3,681.6

216.4

(75.7)

Cash & cash equivalents at the end of the period

4,455.3

3,681.6

216.4

2.5.1Net cash flows related to operating activities

Amounts received for disposal of rental fleet

Amounts received for disposal of the rental fleet increased to EUR 11,529.5 million during the financial year ended 31 December 2024 compared to EUR 7,253.4 million during the financial year ended 31 December 2023, primarily as a result of inclusion of LeasePlan in the consolidation perimeter for 12 months versus from 22 May in 2023 and used car prices still being at a high level.

Amounts paid for acquisition of rental fleet

The amounts paid for the acquisition of the leased vehicles were EUR 21,950.3 million during the financial year ended 31 December 2024 compared to EUR 18,257.1 million during the financial year ended 31 December 2023 as a result of inclusion of LeasePlan in the consolidation perimeter for 12 months versus from 22 May in 2023.

Changes in working capital

Changes in working capital (comprising short-term assets and liabilities) resulted in a net positive contribution to the net cash from operating activities of EUR 1,464.6 million during the financial year ended 31 December 2024 compared to EUR 249.1 million during the financial year ended 31 December 2023. The change is due to the inclusion of LeasePlan in the consolidation perimeter for 12 months in 2024 versus 7 months in 2023 and increase in finance and operating lease receivables invoiced to customers driven by a higher net earning assets value.

Net interest received

Net interest received has increased to EUR 1,472.3 million during the financial year ended 31 December 2024, compared to EUR 979.8 million during the financial year ended 31 December 2023 primarily as a result of inclusion of LeasePlan in the consolidation perimeter for 12 months versus from 22 May in 2023 and a rise in interest rates from 2023 which resulted in higher cash in and outflows.

-

2.7Share capital and shareholder structure

2.7.1History of the Company’s share capital over the past three years

In December 2022, the Company raised its capital by approximately EUR 1.2 billion, through a rights issue with shareholders’ preferential subscription rights, whose purpose was to finance part of the cash component of the LeasePlan acquisition price. 161,641,456 new ALD shares with a par value of EUR 1.50 per share were issued by the Company and admitted to trading on Euronext Paris from 20 December 2022. These new shares were assimilated to the existing shares of the Company, on the same trading line and with the same ISIN code.

On 22 May 2023, the Company issued 251,215,332 new ALD shares to the benefit of LeasePlan’s selling shareholders representing 30.75% of ALD’s share capital as at the date of completion of the acquisition, i.e. the securities component of the acquisition price. These new shares, with a par value of EUR 1.50 per share, were admitted to trading on Euronext Paris on 24 May 2023, with initial ISIN code FR001400FYA8. They were assimilated to the existing shares of the Company on 5 June 2023, on the same trading line and with the same ISIN code (FR0013258662).

On 14 May 2024, the Combined Shareholders Meeting approved to change its name from ALD to Ayvens. Additionally, shareholders renewed the authorization to buy back Ayvens' shares, allowing the Board of Directors to repurchase shares up to 5% of the total number of outstanding shares. The program is designed in connection with the execution of Ayvens liquidity contract and the allocation of performance shares.

-

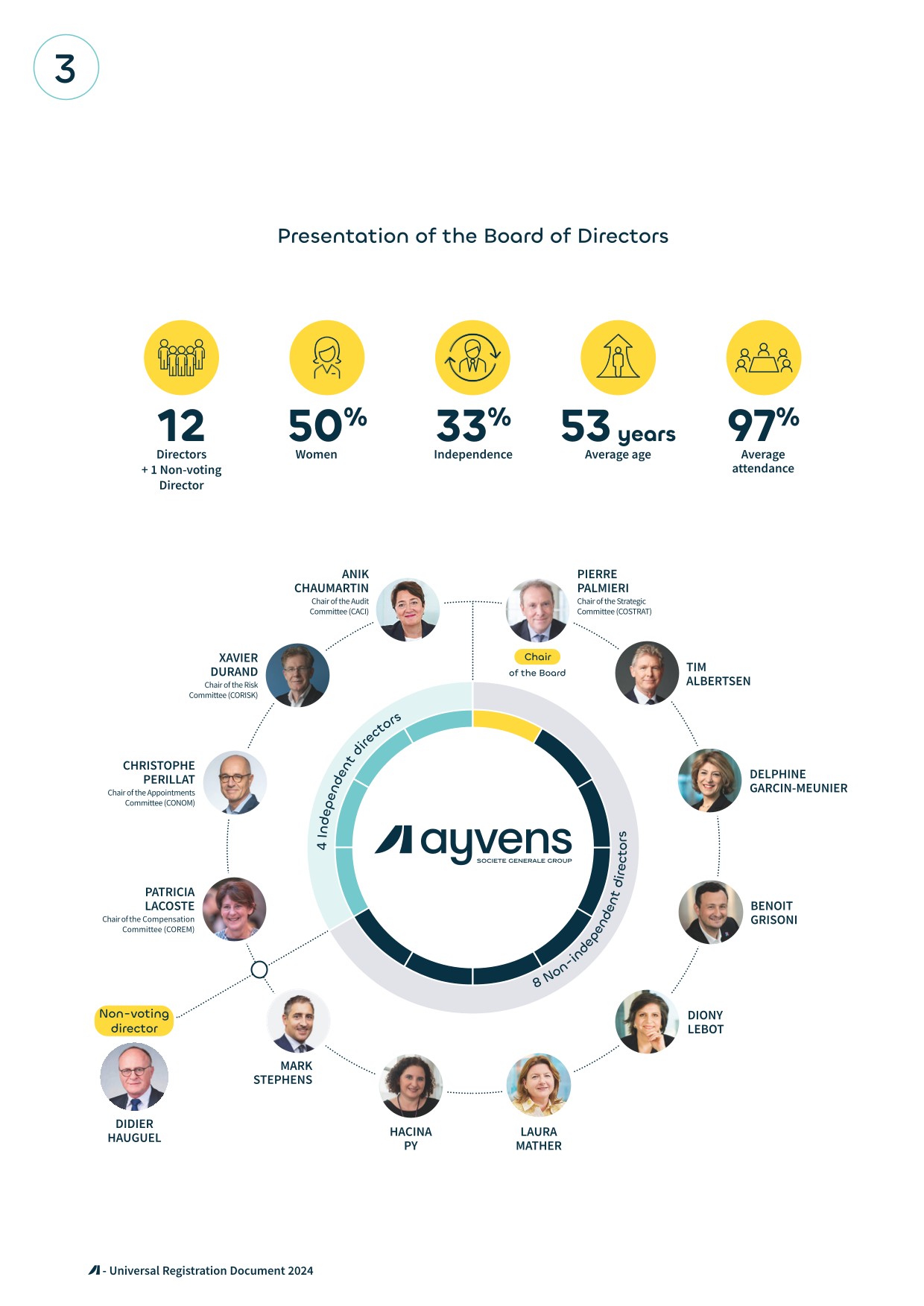

3.1Composition of administrative and management bodies

The Company is a limited liability company (société anonyme) with a Board of Directors. A description of the main provisions of the Bylaws of the Company (the “Bylaws”), relating to the functioning and powers of the Board of Directors of the Company (the “Board of Directors” or the “Board”), as well as a summary of the main provisions of the internal regulations of the Board of Directors and of the committees are included in Section 3.3 “Rules applicable to the administrative and management bodies” and Chapter 7 of this Universal Registration Document.

3.1.1Board of Directors

Name of Directors

Personal information

Experience

Position within the Board

Participation in Board committees

Age

Gender

Nationality

Number of shares

Number of mandates in listed companies

Indepen-

denceInitial

date of appointment/

co-optationTerm of the mandate (General Meeting)

Seniority of the Board (in years)

Pierre PALMIERI

(Chairperson of the Board of Directors)

62

M

French

0

1

no

24/05/23

2027

2

0 including COSTRAT (Chairperson)

Diony LEBOT

62

F

French

13,263

1

no

27/08/20

2027

5

2

Tim ALBERTSEN

62

M

Danish

56,281

0

no

26/03/21

2027

4

_

Xavier DURAND

60

M

French

8,540

1

yes

16/06/17

2025

8

2 including CORISK (Chairperson)

Benoît GRISONI

50

M

French

0

0

no

19/05/21

2025

4

_

Patricia LACOSTE

63

F

French

7,400

1

yes

16/06/17

2027

8

2 including COREM (Chairperson)

Anik CHAUMARTIN

63

F

French

1,407

1

yes

20/05/20

2024

5

2 including CACI (Chairperson)

Christophe PÉRILLAT

59

M

French

1,000

1

yes

16/06/17

2024

8

2 including CONOM (Chairperson)

Delphine GARCIN-MEUNIER

48

F

French

0

2

no

05/11/19

2025

6

5

Hacina PY

53

F

French

0

0

no

22/05/23

2026

2

_

Laura MATHER

54

F

British

0

0

no

15/12/23

2026

2

_

Mark STEPHENS

42

M

Irish

0

0

no

22/05/23

2026

2

2

Note 1: the subsidiaries of Ayvens are not mentioned in the data below and companies followed by (*) are controlled by Societe Generale.

Note 2: the counting of the number of mandates in listed companies does not take into account mandates held in the Company.

Date of birth:

11 November 1962First appointment:

24 May 2023Term of the mandate:

2027Holds:

0 Ayvens sharesProfessional address:

Tours Societe Generale75886 Paris CEDEX 18

Pierre PALMIERI

Expertises

Director, Chairperson of the Board of Directors,

Chairperson of the Strategic Committee

Deputy CEO Of Societe Generale

Pierre PALMIERI (French citizen) has been Deputy Chief Executive Officer and member of the Executive Management and Executive Committee of Societe Generale Group since May 2023. He has more than 30 years of experience in several corporate and investment banking businesses in France and abroad.

Pierre PALMIERI joined Societe Generale in 1987, more specifically the Export Financing department of Societe Generale Corporate & Investment Banking, before heading the financial engineering team in 1989. He joined the Agence Internationale team in 1994, where he created the Global Commodities Financing business line, before being appointed Head of Structured Commodities Financing in 2001. In 2006, he created the Natural Resources and Energy business line, where he became Co-Global Head. In 2008, he was appointed Deputy Head of Financing Activities (Global Finance), then Head from 2012 to 2019. From 2019 until May 2023, he was Head of all Global Banking & Advisory activities.

Pierre PALMIERI is a graduate of the Ecole Supérieure de Commerce de Tours.

Other offices held currently:

French and foreign listed companies:

- ●Societe Generale (France), Deputy CEO since 05/23

Other offices and positions held in other companies in the last five years:

French and foreign unlisted companies:

- ●Societe Generale Luxembourg * – Director from 2012 to 2019

- ●SG Marocaine De Banques * – Director from 2022 to 2023

Date of birth:

15 July 1962First appointment:

27 August 2020Term of the mandate:

2027*Holds:

13,263 Ayvens sharesProfessional address:

Tours Societe Generale

75886 Paris CEDEX 18Diony LEBOT

Expertises

Director, member of the Compensation Committee,

the Nominations Committee and the Strategic Committee

Advisor to the General Management of Societe Generale

Diony LEBOT (French citizen) has been an advisor to the General Management of Societe Generale since May 2023. Diony LEBOT joined Societe Generale in 1986. She held several positions in structured finance activities there, the Financial Engineering Department and then as Director of Asset Financing, before joining the Corporate Client Relations Department in 2004 as Commercial Director for Europe in the Large Corporates and Financial Institutions division. In 2007, she was appointed Chief Executive Officer of Societe Generale Americas and joined the Group’s Executive Committee. In 2012, she became Deputy Director of the Client Relations and Investment Banking division and Head of the Western Europe region of Corporate Banking and Investor Solutions. In March 2015, Diony LEBOT was appointed Deputy Head of Risks and then Head of Risks for Societe Generale in July 2016. In May 2018, she became Deputy Chief Executive Officer of Societe Generale. From 2020 to 2023, she chaired the Board of Directors of Ayvens then has been a Board member until 3 March 2025. Diony LEBOT holds a DESS in Finance and Taxation from the University of Paris I.

Other offices held currently:

French and foreign listed companies:

- ●EQT AB (Sweden) – Director since 06/20

- ●Alpha Bank – Director since 07/23

Other offices and positions held in other companies in the last five years:

French and foreign listed companies:

- ●Societe Generale ** (France), Deputy CEO from 2018 to 2023

French and foreign unlisted companies:

- ●Sogecap ** (France), Director from 2016 to 2018

- ●Sogecap ** (France), Chairperson of the Board of Directors and Director from 2020 to 2023

*Diony LEBOT resigned with effect as of 3 March 2025.

**Societe Generale Group.

Date of birth:

19 June 1961First appointment:

20 May 2020Term of the mandate:

2028Holds:

1,407 Ayvens sharesProfessional address:

7 avenue de Camoens,

75116 ParisAnik CHAUMARTIN

Expertises

Independent Director, Chairperson of the Audit Committee,

member of the Risk Committee

Anik CHAUMARTIN (French citizen) is a chartered accountant, Statutory Auditor and retired partner of PwC France. Global Relationship Partner at PwC for over 20 years, she has 37 years of experience in consulting and auditing, particularly in the financial services and consumer goods sectors. She has also held, for more than 15 years, various managerial responsibilities within PwC, in France or internationally, as COO of PwC Audit France (2005-2008), Human Capital Leader of PwC France (2008-2013), Head of Audit France (2011-2013), Global Assurance Leader – member of the Executive Committee of the global audit activities (2013-2018) and member of the management team of PwC Financial services in France (2018-June 2021). Anik CHAUMARTIN is a graduate of the Ecole Supérieure de Commerce de Paris.

Other offices held currently:

Foreign listed companies:

- ●Director of Allied Irish Bank and Allied Irish Group plc

French and foreign unlisted companies:

- ●Director of La Banque Postale

- ●Director of Saol Assurance Dac (since 13/10/22)

- ●Saol Assurance Holdings (since 17/01/23)

Other offices and positions held in other companies in the last five years:

- ●Global Assurance Markets Leader, PwC Global Network (2013-2018)

- ●Member of the Leadership Team of PwC Financial Services France (2018-June 2021)

- ●President of the CNCC Banking Commission (until April 2022)

Date of birth:

27 April 1964First appointment:

16 June 2017Term of the mandate:

2025Holds:

8,540 Ayvens sharesProfessional address:

Place Costes – Bellonte

92270 Bois-ColombesXavier DURAND

Expertises

Independent Director, Chairperson of the Risk Committee,

member of the Audit Committee

Chief Executive Officer of the Coface Insurance Group

Xavier DURAND (French citizen) is the CEO of the Coface Group since February 2016. Previously, Xavier DURAND had an international career within the financial activities of the General Electric Company where, prior to being Head of Strategy & Growth for GE Capital International based in London (2013-2015), he was the Chief Executive Officer of GE Capital Asia Pacific (2011-2013) based in Tokyo, Chief Executive Officer of the Europe and Russia banking activities of GE Capital (2005-2011), Chairperson and Chief Executive Officer of GE Money France (2000-2005) and Head of Strategy and New Partnerships of GE Capital Auto Financial Services based in Chicago (1996-2000). Earlier, Xavier DURAND was Chief Operating Officer of Banque Sovac Immobilier in France from 1994 to 1996. Engineer of Ponts et Chaussées corps, Xavier DURAND graduated from the Ecole Polytechnique and the Ecole des Ponts ParisTech. He started his career in 1987 in consulting (Gemini Group), strategy and project management (GMF, 1991-1993).

Other offices held currently:

French listed company:

- ●Coface SA – Chief Executive Officer since 2016

Within Coface – French and foreign unlisted company:

- ●Compagnie française d’assurance pour le commerce extérieur (Coface) – Chairperson of the Board of Directors – Managing Director – Director

- ●Coface North America Holding Company – Chairperson of the Board of Directors and Director

Date of birth:

30 June 1976First appointment:

5 November 2019Term of the mandate:

2025Holds:

0 Ayvens sharesProfessional address:

Tours Societe Generale

75886 Paris CEDEX 18Delphine GARCIN-MEUNIER

Expertises

Director, member of the Audit Committee, the Risk Committee,

the Nomination Committee and the Strategy Committee

Head of Mobility and International Retail Banking & Financial Services

at Societe Generale, Member of Societe Generale Executive Comittee

Since May 2023, Delphine GARCIN-MEUNIER (French citizen) has been Director of Mobility and International Retail Banking & Financial Services, and a member of the Executive Committee of Societe Generale. She was previously Head of Group Strategy from 2020 after heading Investor Relations and Financial Communication for the Group from 2017 to 2020. In 2001, she joined Societe Generale and more specifically the Equity Capital Markets Department of SG CIB where she was in charge of originating and executing of primary issues on the equity and equity-linked markets for a portfolio of large companies for 13 years. In 2014, Delphine GARCIN-MEUNIER joined the Strategy Department within the Finance and Development Department, with a particular focus on retail banking in France, Transaction Banking activities, and the relationship model of Corporate & Investment Banking, securities and asset management. She participated in various transactions within the Strategy Department from 2015 to 2017 (including the IPO of ALD and Amundi). She began her career in 2000 at ABN Amro Rothschild in the Equity Capital Markets teams. Delphine GARCIN-MEUNIER is a graduate of HEC and the Sorbonne University.

Other offices held currently:

French and foreign listed companies:

- ●BRD * – Chairwoman of the Board of Directors since May 2024 and Director since December 2023

- ●KOMERCNI BANKA * – Chairwoman of the Supervisory Board of Directors and Director since February 2024

Other offices and positions held in other companies in the last five years:

French and foreign unlisted companies:

- ●SG Algérie * – Member of the Supervisory Board from 2021 to 2023

- ●Sogecap * (France) – Director in 2023

*Societe Generale Group.

Date of birth:

5 December 1961First appointment:

16 June 2017Term of the mandate:

2027Holds:

7,400 Ayvens sharesProfessional address:

19, rue d’Aumale

75009 ParisPatricia LACOSTE

Expertises

Independent Director, Chairperson of the Compensation Committee,

member of the Nomination Committee

Chairperson and Chief Executive Officer of the Prevoir Insurance Group

Patricia LACOSTE (French citizen) has been Chairperson and Chief Executive Officer of the Insurance group Prevoir since 2012. Previously, Patricia LACOSTE spent some 20 years in SNCF (French National Railway Company), where she held several executive positions, notably Director in charge of managing Top Executives within the HR Division (2008-2010), Director of the Eastern Paris Region, in charge of preparing the launch of the East Europe high speed train TGV (2005-2008), and Director of Sales to individuals (1995-2004). Patricia LACOSTE has graduated from the École nationale de la statistique et de l’administration économique (ENSAE), and she holds a Master in Econometrics. She started her career as study engineer in the consulting firm Coref (1985-1992).

Other offices held currently:

Within PREVOIR – French and foreign unlisted companies:

- ●Société Centrale PREVOIR – Chairperson and CEO

- ●PREVOIR-Vie – Chairperson

- ●Société de Gestion PREVOIR – Legal representative of Société Centrale PREVOIR – Director

- ●MIRAE ASSET PREVOIR LIFE Vietnam – Legal representative of PREVOIR-Vie – Director

- ●ASSURONE – Member of the Supervisory Board

- ●UTWIN – Member of the Supervisory Board

- ●SARGEP – Director

- ●PREVOIR Foundation – Member of the Executive Board

- ●Reassurez-Moi - Chairperson

Outside Prevoir – French and foreign listed companies:

- ●SCOR SE – Independent Director, member of the Strategy Committee, the Compensation Committee, the Audit Committee, the Nomination Committee and the Sustainability Committee

Other offices and positions held in other companies in the last five years:

French and foreign unlisted companies:

- ●SNCF Reseau – Director

- ●PREVOIR Risques Divers – Chairperson and CEO

- ●PKMI (PREVOIR Kampuchea Micro Life Insurance) – Legal representative of PREVOIR-Vie – Director

- ●Lloyd Vie Tunisie – Legal representative of Prevoir Vie, Director

Date of birth:

12 September 1965First appointment:

16 June 2017Term of the mandate:

2028Holds:

1,000 Ayvens sharesProfessional address:

100, rue de Courcelles

75017 ParisChristophe PÉRILLAT

Expertises

Independent Director, Chairperson of the Nomination Committee

and member of the Compensation CommitteeChief Executive Officer of Valeo

Christophe Perillat joined the Valeo Group in 2000 and held a number of management positions in Group entities of increasing size before becoming Chief Operating Officer in 2011, Associate Chief Executive Officer in 2020, Deputy Chief Executive Officer in 2021 and Chief Executive Officer in January 2022. Prior to joining Valeo, Christophe Perillat worked in the aerospace industry at the equipment manufacturer Labinal, where he held roles in supply chain management, as well as plant, project and subsidiary management positions in France and the United States. Christophe Perillat is a graduate of Ecole polytechnique and Ecole des mines de Paris. He also holds an EMBA from the French business school HEC. Christophe Perillat is a French citizen and speaks French and English.

Other offices held currently:

French listed company:

- ●Valeo – Chief Executive Officer (since January 2022)

Unlisted French company:

- ●None

Unlisted foreign companies:

- ●Valeo Service Espana SAU – Spain – Director

Other offices and positions held in other companies in the last five years:

- ●Valeo SpA – Italy – Chairman of the Board of Directors (until 13 December 2024)

- ●Valeo North America, Inc. – USA – Chairperson and Director (until 12 January 2024)

- ●Valeo (UK) Limited – United Kingdom – Chairperson and Director (until 5 December 2024)

Date of birth:

13 August 1974First appointment:

19 May 2021Term of the mandate:

2025Holds:

0 Ayvens sharesProfessional address:

44, rue Traversiere

92100 Boulogne-BillancourtBenoît GRISONI

Expertises

Director,

Chief Executive Officer of Boursorama

Benoît GRISONI (French citizen) is a member of the Board of Directors of Ayvens since May 2021. He is also Chief Executive Officer of BoursoBank (ex-Boursorama) since 2018, after having served as Deputy Chief Executive Officer from 2016 to 2017. Previously, Benoît GRISONI held several management positions and was a member of the Executive Committees of BoursoBank as Director of BoursBank from 2010 to 2015, Deputy Director of BoursoBank from 2006 to 2009 and Director of Boursorama Invest from 2002 to 2005. Before joining BoursoBank, Benoît GRISONI began his career at Fimatex where he was Director of Customer Services and Marketing from 1999 to 2001, after joining the Company as a Client Manager in 1998. Benoît GRISONI obtained a diploma in accounting and financial studies as well as a specialisation diploma in capital markets at ICS Begue in 1997 before continuing his training at the Ecole Supérieure Libre des Sciences Commerciales Appliquées in 1998 as part of a postgraduate course in Trading-Finance and International Trading.

Other offices held currently:

French listed companies:

- ●BoursoBank * – Managing Director

- ●BoursoBank * – Director

Unlisted French company:

- ●Sogecap * – Director

Other offices and positions held in other companies in the last five years:

Unlisted French company:

- ●Peers – Member of the Supervisory Board

*Societe Generale Group.

Date of birth:

25 July 1970First appointment:

15 December 2023

(co-optation)Term of the mandate:

2026Holds:

0 Ayvens sharesProfessional address:

Tours Societe Generale

75886 Paris CEDEX 18Laura MATHER

Expertises

Director,

Chief Operating Officer of Societe Generale

Since May 2023, Laura MATHER (British citizen) has been Chief Operating Officer of Societe Generale and a member of the Executive Committee. Laura MATHER joined the Crédit Suisse Group in 1994 where she was in charge of numerous managerial functions within the IT teams. In 2012, she was appointed Head of Information Technology for EMEA and then Global Head of Production and Testing Group in 2013. In 2014, she became Chief Technology Officer, in charge of IT infrastructure and Chief Information Security Officer for Crédit Suisse Group. Since 2019, she has held the position of Global Chief Information Officer of Crédit Suisse Group. Laura MATHER is a graduate of the University of the Witwatersrand in South Africa.

Other offices held currently:

Unlisted foreign companies:

- ●Tech For All – Director

Foreign listed companies:

- ●Cohesity Inc. – Member of Security Advisory Council

Other offices and positions held in other companies in the last five years:

- ●Societe Generale – Forge * – Director

*Societe Generale Group.

Date of birth:

15 September 1971First appointment:

22 May 2023Term of the mandate:

2026Holds:

0 Ayvens sharesProfessional address:

Tours Societe Generale

75886 Paris CEDEX 18Hacina PY

Expertises

Director,

Head of Sustainable Development, Societe Generale

Since October 2021, Hacina PY (French citizen) has been Head of Sustainable Development for Societe Generale and a member of the Executive Committee. Hacina PY joined Societe Generale in 1995 and has developed a solid banking experience in both structured finance and corporate functions. Hacina PY became Global Head of Export Financing in 2015. She led the transformation of this business by directing the strategy towards sustainable development and became leader of the impact finance solutions teams in 2019. Hacina PY is a graduate of EM Strasbourg and studied Finance at Heriot Watt University in Edinburgh.

Other offices held currently:

- ●None.

Other offices and positions held in other companies in the last five years:

- ●GEFA BANK GmbH * – Member of the Supervisory Board from 2021 to 2023

*Societe Generale Group.

Date of birth:

19 June 1982First appointment:

22 May 2023Term of the mandate:

2026Holds:

0 Ayvens sharesProfessional address:

20 Bentinck Street,

London W1U 2EU

UNITED KINGDOMMark STEPHENS

Expertises

Director, member of the Risk Committee and the Strategic Committee

Partner of TDR Capital LLP

Mark STEPHENS (Irish citizen) has been a partner at TDR Capital LLP since December 2018. Having joined TDR Capital LLP in 2012, he successively held the positions of Associate (2012-2014) and Director (2014-2018). Before joining TDR, Mark STEPHENS worked at Morgan Stanley in London as an analyst in the UK investment banking team and then as an associate at its private equity fund. Mark STEPHENS holds a Bachelor of Business and Legal Studies (European) with first class honours from University College Dublin.

Other offices held currently:

- ●TDR CAPITAL LLP – Partner

- ●Constellation Automotive Holdings ltd. – Director

- ● Deuce HoldCo Limited – Director

- ●Flight Club Darts Limited – Non-executive Director

Other offices and positions held in other companies in the last five years:

- ●Lincoln Financing PTE Limited – Director

Date of birth:

9 February 1963First appointment:

26 March 2021Term of the mandate:

2027Holds:

56,281 Ayvens sharesProfessional address:

1, rue Eugène et Armand Peugeot

92500 Rueil-MalmaisonTim ALBERTSEN

Expertises

Chief Executive Officer

Tim ALBERTSEN is Chief Executive Officer of the Ayvens Group.

He has over 30 years of experience in the sector.Tim ALBERTSEN (Danish citizen) has been Chief Executive Officer of the Ayvens Group since March 27, 2020 and previously served as Deputy Chief Executive Officer from 2011. Tim ALBERTSEN has more than 30 years of experience in the leasing and Fleet Management sector, notably at Avis Leasing, Avis Rent a Car and Hertz Lease, acquired by Ayvens in 2003. Before being appointed CEO of Ayvens in 2020, he held the positions of Regional Director in the Nordic and Baltic countries, CEO of Axus Denmark & Sweden from 1997 to 2003, CEO of Hertz Lease Denmark, Chief Operating Officer, Senior Vice-Chairperson and Deputy Chief Executive Officer, where he played a key role in the success of the Company’s listing on Euronext Paris. Tim ALBERTSEN holds an undergraduate degree and a postgraduate degree in business administration from the University of Southern Denmark and the Copenhagen Business School respectively.

Other offices held currently:

- ●Ayvens – CEO

Other offices and positions held in other companies in the last five years:

Unlisted foreign companies:

- ●CarTime Technologies – Denmark – Director

- ●Mil-tekUS – USA – Director

Non-voting member

In 2024, the Board of Directors was assisted by a non-voting member whose role was to support it in monitoring the integration of LeasePlan, the Company’s evolution towards a regulated status of CFH and the smooth operation of the new governance.

Date of birth:

14 December 1959First appointment:

24 May 2023 (non-voting member)Term of the mandate:

2026Holds:

7,516 Ayvens sharesProfessional address:

1, rue Eugène et Armand Peugeot92500 Rueil-Malmaison

Didier HAUGUEL

Expertises

Non-voting member,

director, consultant, mediatorDidier HAUGUEL (French citizen) has been a non-voting member of Ayvens since May 2023. A director of Ayvens since 2009, he was Chairperson of the Board of Directors from 2009 to 2011 and then from 2017 to 2019. Since 2019, he has held non-executive roles as an independent director, consultant and mediator. He was a member of Societe Generale Management Committee from 2000 to 2019, he was Country Officer for Russia from 2012 to 2019. Member of the Societe Generale Executive Committee from 2007 to 2017, he had been Co-Head of International Banking and Financial Services from 2013 to 2017 and held several positions in Societe Generale, such as Head of Specialised Financial Services and Insurance from 2009 to 2013 and Chief Risk Officer from 2000 until 2009. After having been Head of Central Risk Control at Societe Generale from 1991 to 1995, he was appointed Chief Operating Officer of Societe Generale in New York (USA) from 1995 to 1998, then Director of Resources and Risk for the Americas Regional Division from 1998 to 2000. He joined the General Inspection Department of Societe Generale in 1984. Didier HAUGUEL has graduated from the Institut d’études politiques de Paris (Sciences Po) and holds a Bachelor’s degree in Public law.

Other offices held currently:

Unlisted French companies:

- ●Société Centrale Prévoir – Director

Other offices and positions held in other companies in the last five years:

Unlisted foreign companies:

- ●GEFA Bank GmbH * – Germany – Chairperson and Director

- ●LLC Rusfinance * – Russia – Director

- ●Riverbank – Luxembourg – Director

Foreign listed company:

- ●PJSC Rosbank * – Russia – Chairperson and Director

*Societe Generale Group.

3.1.1.1Directors’ independence

Four independent directors sit on the Board of Directors. Their independence was assessed considering the criteria set out in Article 10.5 of the AFEP-MEDEF Code, and in particular information relating to their professional careers, past and current mandates, and the business relationships of their employers/companies with Societe Generale Group.

The assessment of the existence of significant business relationships is the subject of an assessment conducted by the Board of Directors during the director selection process, in addition to the analysis and assessment conducted by the Nomination Committee of the Board of Directors of any potential conflict of interest situation relating to each member of the Board of Directors, which leads its members to pay particular attention to these relationships.

In this respect, the Board particularly studies the Fleet Management services provided by the Company to companies of which its Directors are executives (Xavier DURAND, Chief Executive Officer of COFACE, Christophe PERILLAT, Chief Executive Officer of VALEO, and Patricia LACOSTE, Chief Executive Officer of the PREVOIR Group), in order to assess whether these are of such importance and nature as to affect the independence of judgement of these directors. The Board noted that the Fleet of vehicles managed by the Company on behalf of companies whose senior executives are Directors is insignificant or marginal. Consequently, the commercial and financial relationships resulting from such a service between the Directors, the groups they manage, and the Company are not such as to modify the analysis of their independence.

At the same time, the relationships between the groups of which these Directors are senior executives and Societe Generale Group were examined, and the non-material nature, within the meaning of Article 10.5.3 of the AFEP-MEDEF Code, of the existing business volumes between the groups was reviewed and Societe Generale Group was confirmed at the end of this review.

Finally, it should be noted that these contractual relationships are also subject to an annual review by the Board of Directors, which verifies the proper application of the procedure implemented pursuant to Article L. 22-10-12 of the French Commercial Code. While this procedure is specifically intended to verify the nature and the contractual conditions under which these relationships are entered into and is not primarily intended to judge their materiality, it offers the Audit Committee the opportunity to assess the importance that they have for the group through various criteria such as risk exposure, Fleet size, or share in the Group’s overall debt, etc.

The following table summarises the assessment of the independence of directors according to the following criteria. ✔ represents a satisfied independence criterion and ✘ represents an unsatisfied independence criterion.

Criteria

Pierre PALMIERI

Tim ALBERTSEN

Xavier DURAND

Benoît GRISONI

Patricia LACOSTE

Anik CHAUMARTIN

Diony LEBOT

Christophe PERILLAT

Delphine GARCIN-

MEUNIERHacina

PYLaura MATHER

Mark STEPHENS

Salaried corporate officer during the previous five years (1)

✔

✘

✔

✘

✔

✔

✘

✔

✘

✘

✘

✔

Cross

-directorships (2)✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

Significant business relationships (3)

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

Family connections (4)

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

Statutory Auditor (5)

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

Term of office greater than 12 years (6)

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

Status of

non-executive corporate officer (7)✘

✘

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

Status of significant shareholder (8)

✘

✔

✔

✔

✔

✔

✔

✔

✔

✔

✔

✘

- (1)Not being or not having been, during the previous five years:

- •salaried employee or executive corporate officer of the Company;

- •salaried employee, executive corporate officer or director of a company consolidated by the Company;

- •salaried employee, executive corporate officer or director of the Company’s parent company or a company consolidated by this parent company.

- (2)Not being an executive corporate officer of a company in which the Company directly or indirectly holds a directorship or in which an employee designated as such or an executive corporate officer of the Company (current or having been one within the past five years) holds a directorship.

- (3)Not being a customer, supplier, investment banker, commercial banker or consultant:

- •significant for the Company or its group;-

- •or for which the Company or its group represents a significant share of business.

- Assessment of whether or not the relationship with the Company or its group is significant is debated by the Board and the qualitative and quantitative criteria leading to this assessment (continuity, economic dependency, exclusivity, etc.) are explained in the annual report.

- (4)Not having family ties with a corporate officer.

- (5)Not having been a Statutory Auditor of the Company during the previous 5 years.

- (6)Not having been a director of the Company for more than 12 years. The loss of the status of independent director occurs on the twelve-year anniversary.

- (7)A Non-executive corporate officer cannot be considered as independent if he/she receives variable remuneration in cash or in securities or any remuneration related to the performance of the Company or the Group (Art. 10.6 of the AFEP-MEDEF Code).

- (8)Directors representing large shareholders of the Company or its parent company may be considered as independent as long as these shareholders do not take part in the control of the Company. However, beyond a threshold of 10% in capital or voting rights, the Board, after a report from the Nomination Committee, always queries the qualification of independent person, taking into account the composition of the capital of the Company and the existence of a potential conflict of interest (art. 10.7 of the AFEP-MEDEF Code).

Changes in the composition of the Board of Directors in 2024

Director

Departure

Appointment

Renewal of term

of officeBoard of Directors

Committees

Board of Directors

Committees

Mark STEPHENS

Appointed to CONOM on 30 October 2024

Nomination Committee (CONOM)

Compensation Committee (COREM)

Audit Committee (CACI)

Risk Committee (CORISK)

Strategy Committee (COSTRAT) abolished by the decision of the Board of Directors as at 30 October 2024 (cf 3.1.1.4)

3.1.1.2Balance of the composition of theBoard of Directors

The Board of Directors is composed of 50% of women at the end of the 2024, six women and six men (excluding the non-voting member), which continues to meet current legal requirements and the recommendations of the AFEP-MEDEF Code.

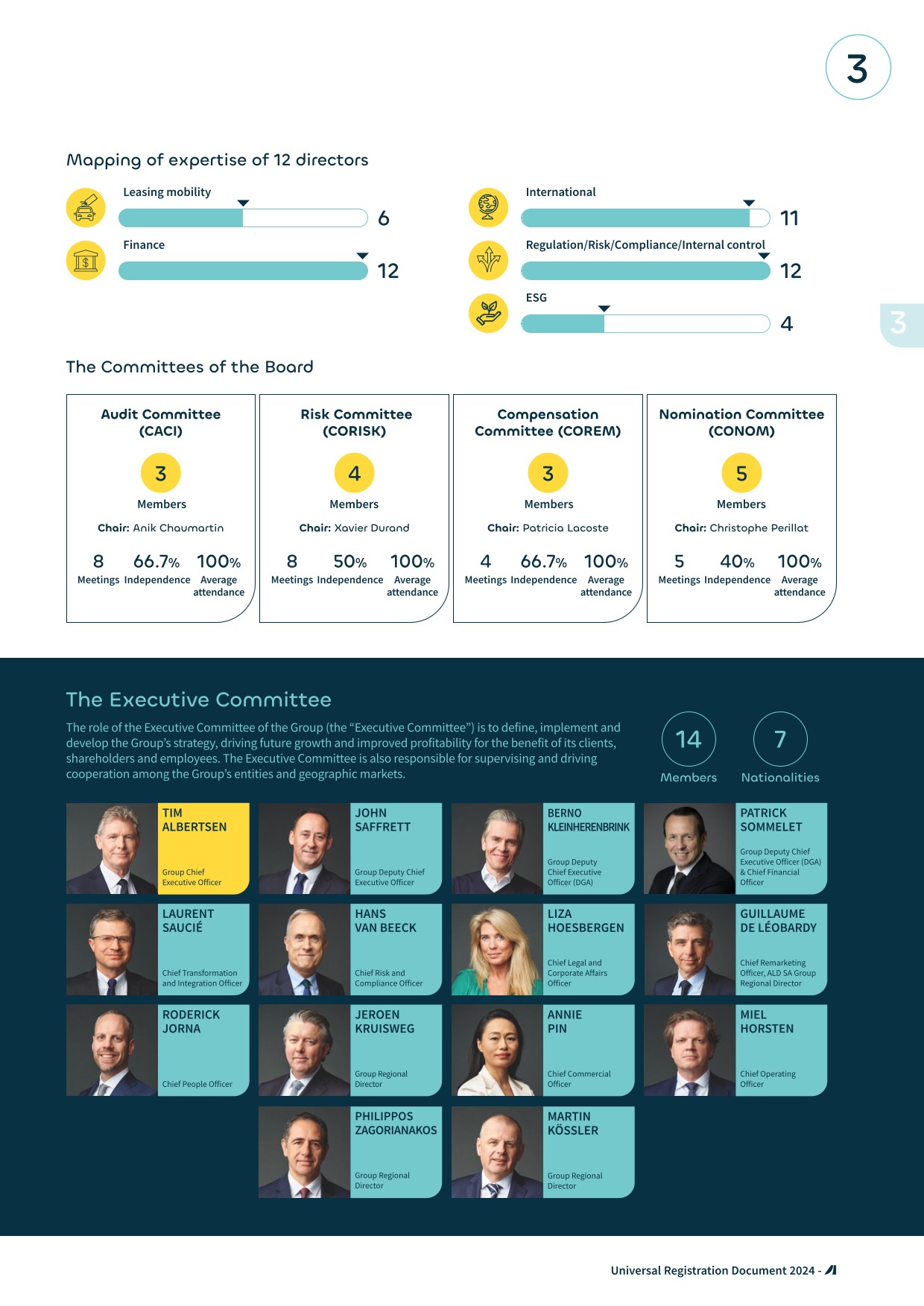

As shown by the tables in 3.1.1 and 3.1.1.3, the composition of the Board of Directors is currently diverse in terms of the age, gender, qualifications and professional experience of the directors. The Board of Directors discussed its composition and deemed it balanced and appropriate in view of the diversity of the profiles and skills.

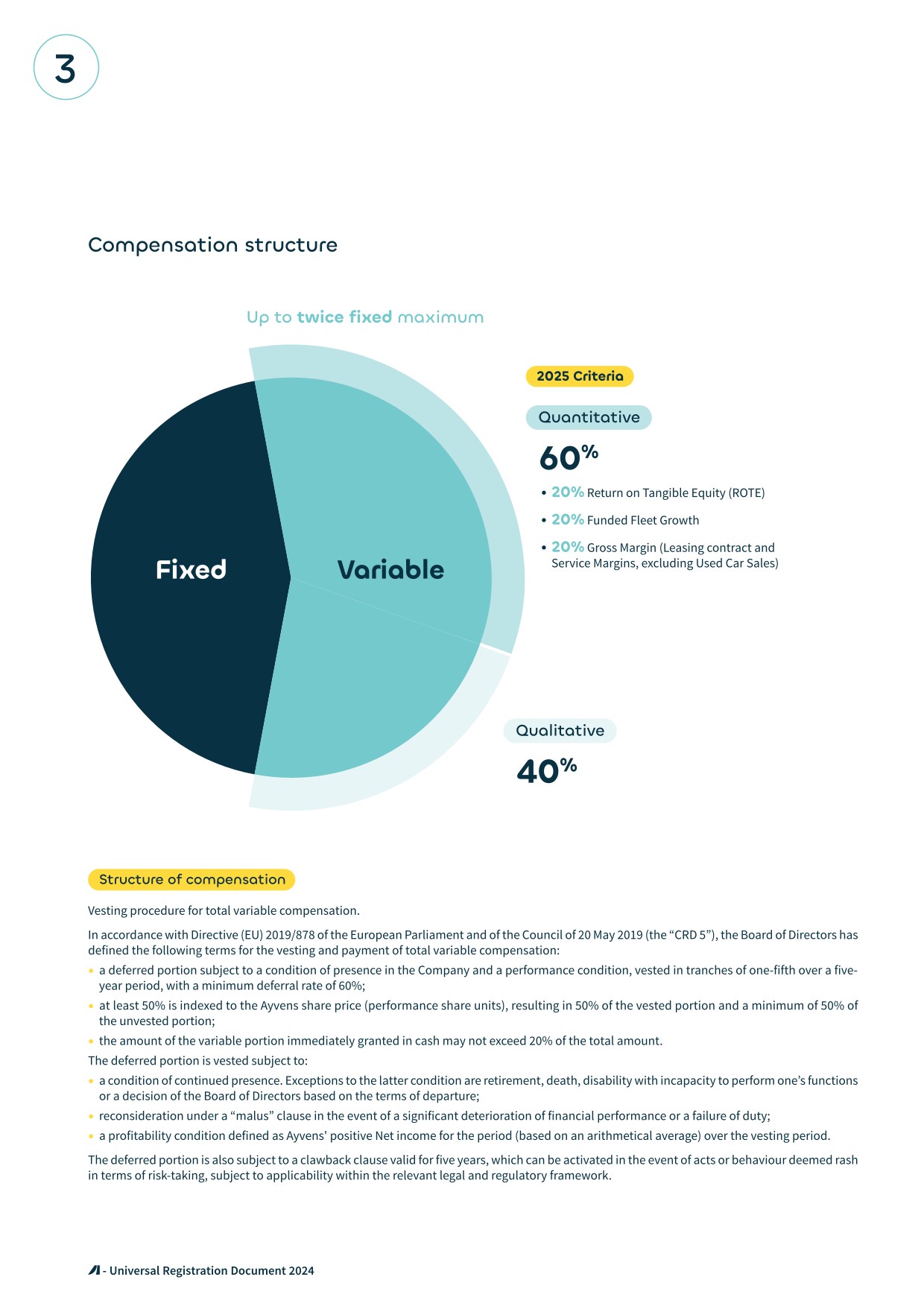

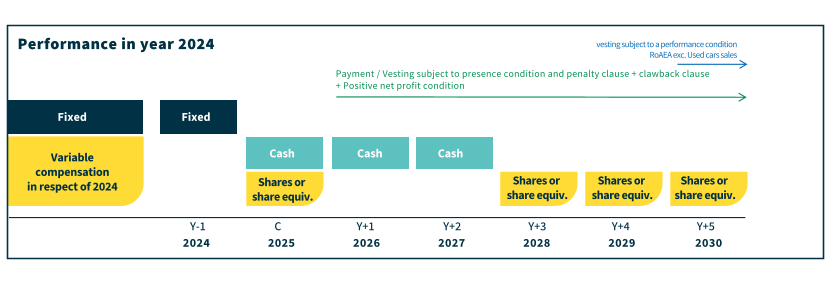

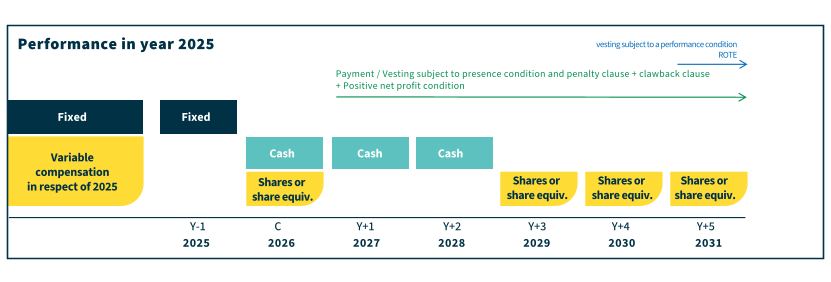

3.1.1.3Directors’ expertise